How often does the S&P 500 lose 10%?

How often do companies fall out of S&P 500

Each year, about 20 to 25 stocks leave the S&P 500 and are replaced with other stocks that meet the guidelines for index membership. These changes usually are announced five trading days before the index change.

Can S&P 500 reach $10,000

The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.

How frequently is the S&P 500 updated

Although the S&P 500 index is rebalanced four times a year, the committee meets monthly and intra-quarter changes may occur. FactSet produces S&P 500 constituent predictions daily.

What is the percentage return of the sp500

Basic Info. S&P 500 1 Year Return is at 17.57%, compared to 1.15% last month and -11.92% last year. This is higher than the long term average of 6.33%. The S&P 500 1 Year Return is the investment return received for a 1 year period, excluding dividends, when holding the S&P 500 index.

Does the S&P 500 double every 5 years

How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.

How much lower will S&P 500 fall

Analysts led by Michael Wilson estimated the S&P could slip to as low as 3,000 points during 2023, according to a note to clients. That indicates 24% downside from the index's 3,930 mark as of Monday and would be the S&P's lowest mark since May 2020.

Is S&P 500 safe long term

History shows us that investing in an S&P 500 index fund — a fund that tracks the S&P 500's performance as closely as possible — is remarkably safe, regardless of timing. The S&P 500 has never produced a loss over a 20-year holding period.

Is the SP 500 a good long term investment

Legendary investor Warren Buffet once said that all it takes to make money as an investor is to 'consistently buy an S&P 500 low-cost index fund. ' And academic research tends to agree that the S&P 500 is a good investment in the long term, despite occasional drawdowns.

What is the S&P 500 annual return last 5 years

Stock Market Average Yearly Return for the Last 5 Years

The historical average yearly return of the S&P 500 is 11.058% over the last 5 years, as of the end of April 2023.

What is the 3 year return of the S&P 500

S&P 500 3 Year Return is at 43.55%, compared to 37.30% last month and 28.68% last year.

What is the S&P 500 10 year return

S&P 500 10 Year Return (I:SP50010Y)

S&P 500 10 Year Return is at 177.1%, compared to 156.3% last month and 177.9% last year. This is higher than the long term average of 112.9%.

Will my 401k double every 7 years

When does money double every seven years To use the Rule of 72 to figure out when your money will double itself, all you need to know is the annual rate of expected return. If this is 10%, then you'll divide 72 by 10 (the expected rate of return) to get 7.2 years.

Does money double every 10 years

If you earn 7%, your money will double in a little over 10 years. You can also use the Rule of 72 to plug in interest rates from credit card debt, a car loan, home mortgage, or student loan to figure out how many years it'll take your money to double for someone else.

Can the S&P 500 go to 0

And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely. It would, in fact, take a catastrophic event involving the total dissolution of the US government and economic system for this to occur.

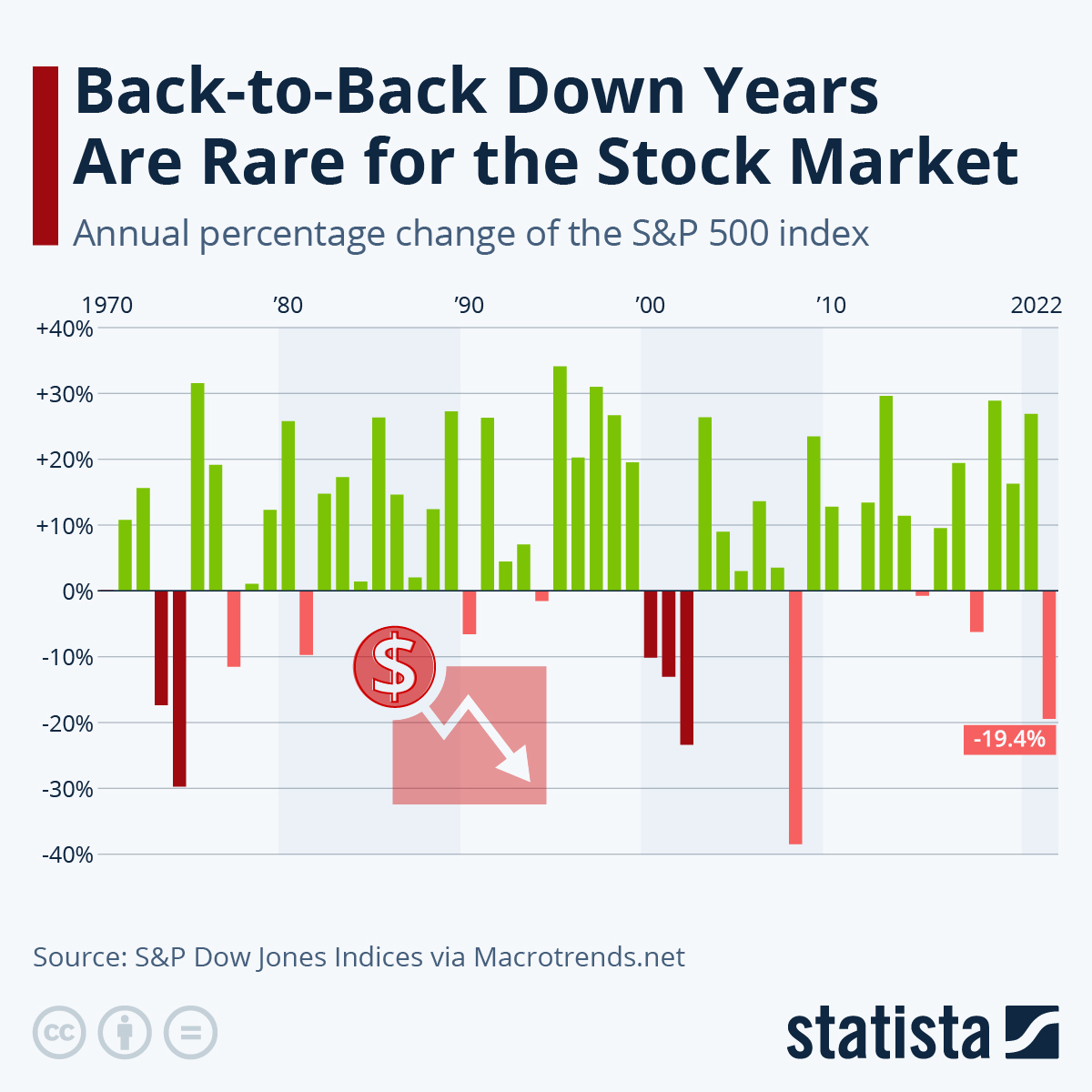

Will S&P 500 drop in 2023

The S&P 500 is up about 9% so far in 2023 after falling 19.4% in 2022. Gains this year are largely thanks to big growth and technology stocks, which have rallied as other areas of the market have faltered, like regional banks.

How long should you hold S&P 500

Regardless of where you invest, it's wise to keep a long-term outlook. The market could be shaky over the coming months or even years. But if you invest in an S&P 500 ETF and hold that investment for at least a couple of decades, you're almost guaranteed to make money.

Is S&P 500 still a good investment 2023

Fortunately, analysts are projecting S&P 500 earnings growth will rebound back into positive territory in the second half of 2023. Analysts expect 0.7% earnings growth in the third quarter and 8.1% growth in the fourth quarter.

What if I invested $1000 in S&P 500 10 years ago

And if you had put $1,000 into the S&P 500 about a decade ago, the amount would have more than tripled to $3,217 as of April 20, according to CNBC's calculations.

Is S&P 500 safe long-term

History shows us that investing in an S&P 500 index fund — a fund that tracks the S&P 500's performance as closely as possible — is remarkably safe, regardless of timing. The S&P 500 has never produced a loss over a 20-year holding period.

How much would $8000 invested in the S&P 500 in 1980 be worth today

To help put this inflation into perspective, if we had invested $8,000 in the S&P 500 index in 1980, our investment would be nominally worth approximately $912,320.82 in 2023. This is a return on investment of 11,304.01%, with an absolute return of $904,320.82 on top of the original $8,000.

Is Investing in S&P 500 safe

History shows us that investing in an S&P 500 index fund — a fund that tracks the S&P 500's performance as closely as possible — is remarkably safe, regardless of timing. The S&P 500 has never produced a loss over a 20-year holding period.

How many years of maxing out 401k to become a millionaire

20 to 25 years

Your millionaire retiree timeline

Unless you have very generous matching rules, it should take 20 to 25 years of maxing out your 401(k) to reach a $1 million balance. Considering that your retirement should last 30 or 40 years, a quarter-century of big contributions should sound like a reasonable trade-off.

Is the Rule of 72 accurate

The Rule of 72 is derived from a more complex calculation and is an approximation, and therefore it isn't perfectly accurate. The most accurate results from the Rule of 72 are based at the 8 percent interest rate, and the farther from 8 percent you go in either direction, the less precise the results will be.

How often does money double at 10%

every seven years

At 10%, you could double your initial investment every seven years (72 divided by 10). In a less-risky investment such as bonds, which have averaged a return of about 5% to 6% over the same time period, you could expect to double your money in about 12 years (72 divided by 6).

What is 72 rule in finance

The Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest. Dividing 72 by the annual rate of return gives investors a rough estimate of how many years it will take for the initial investment to duplicate itself.